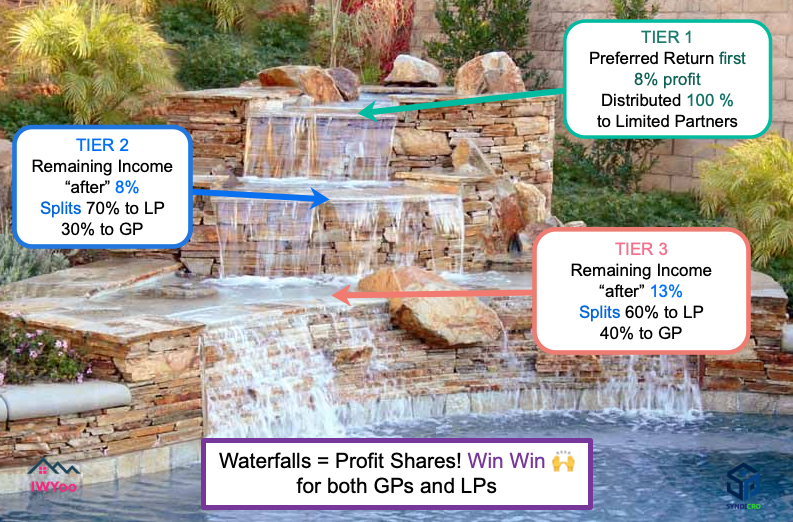

Waterfall Structure in Multifamily Syndication

Please look at the image I created to illustrate how tiered waterfalls 💧 show what limited partners earn from their investment through a multifamily syndication. ❗️Each tier❗️must be achieved before cash flow distributions can flow down to the next level below tier of investors.This is just one of examples but most commonly structured for a multifamily syndication.

Let me start using numbers to explain better.

Lets say you invest $100k in a 5 years holding syndication deal offering 8% preferred return annually “if” the payout starts in January 2021, and lets say annual net cash flow is $14,000 just for each math.

✅ Preferred Return…

That’s $8k preferred return going to passive investors first! ☝️

✅ Split Scenario…

So, we have $6,000 remaining profit after preferred return is paid out to LP. This remaning cash flow will split, so 70% goes to LP, and 30% goes to GP.

$4,200 will be paid to LP. (70% x $6,000)

, and $1,800 to GP. (30% x $6,000)

By now, the total return for LP is

$8,000(from Preferred Return) + $4,200 (Split on Tier 2 Split) = $12,200

Therefore, the total return is 12.2% 😳😳💵💵on $100,000 originally invested❗️❗️

.

.

Is that it??? Nope! 😎

✅Extra Milestone Hurdle > 13%…

Lets say remaining cash flow is $10,000, not $6,000 after Preferred Return 8% is distributed to LPs.

Some syndication split is structured to incentivize sponsors to perform exceptionally. If the return hits 13%, then splits occur 60% to LP and 40% to GP.

So the $4,000 after 2 tier is split, paid to LP and GP.

$2,400 goes to LP (60% x $4,000)

And $1,600 goes to GP (40% x $4,000)

At the end, the total return for LP will be $14,600, which is 14.6% return on their investment as cash flow. 😳😳😳😳😳😳

Again, not all properties generate a such great return. General Partners have to work hard and deliver every business execution on time as planned precisely.

As a LP myself in some deal, I want GPs to make money so I get a higher return!! Win Win!!😎

Obviously there are many different waterfalls structures in many different ways.

Hope this helps you understand what LPs earn from multifamily syndications.

Wait……

There’s more!! 🥳🤩

✅ “In addition”, lets say the deal has equity split between LPs and GPs, 70/30

And the apartment is renovated, is sold at the end of year 5 for a higher value because the rent has been increased from $200 a month increase per unit in a 10 unit property

$200(rent increased) x 10 unit x 12 month

= $24,000 increase in gross income.

$24k increase in gross income at capital rate 5% will add

🔥🔥$480,000 profits at sale!!🔥🔥

$240,000 increased income / 5% capital rate = $480,000 value increased !!🚀🚀

The equity split between LPs and GPs 70/30. Therefore, (70% x $480k) = $336,000 goes to LPs, and the rest would go to GPs.

a.k.a Forced Appreciation!!!

To recap,

5 years of the total preferred return 14.8%

+

Equity split at sale $336,000

+

Alpha

Adding all these called,

✅Equity Multiple

Equity Multiple 2.2 means 2.2 times of the total ROI of capital invested.

Phew!!! That’s a lot of money earning by passively investing in a multifamily syndication!

Are we done yet??

No, there is more,

🤖🤖🤖

.

.

❗️TAX BENEFITs❗️

One of the most fascinating advantages is TAX when investing passively in an apartment syndication.

Stay tuned for next post!